MMUST Finance Department Holds Sensitization Workshop to Its Staff Geared Towards Eliminating Audit Queries and Strengthening Financial Compliance

In a bid to strengthen financial compliance and address recurring audit queries, MMUST’s Finance Department conducted a comprehensive sensitization workshop aimed at equipping its staff with the knowledge and skills needed to reduce audit queries and improve compliance with financial regulations. The workshop which took place from 13th to 15th June 2025 at Lintons Hotel-Busia, was steered by the Finance Officer, CPA Jared G. O. O. Rading’. The initiative ‘Action Plan for Zero Audit Queries 2025/26’ reflects the Department’s commitment to fostering a culture of accountability, efficient financial management and reporting within the University.

The Finance Officer, CPA Jared G. O. O. Rading’ addresses participants at the workshop.

Addressing participants at the opening session, CPA Rading’ emphasized the critical role of sound financial practices in upholding the integrity and credibility of the University’s operations. “Reducing audit queries is not merely a compliance issue. It is key in protecting the institution’s reputation and ensuring the optimal use of public resources. Through this workshop, we aim to build the capacity of our staff to ensure strict adherence to financial guidelines and procedures. Our vision is to ensure we attain zero audit queries in the next Financial Year,” stated CPA Rading’.

Additionally, CPA Rading’ took the participants through the ‘Preparation of Financial Statements and the Implementation of new International Public Sector Accounting Standards (IPSAS) and International Financial Reporting Standards (IFRS). This extensive session provided the University Finance personnel with a deep dive into diverse financial reporting frameworks and how they apply to public sector entities like MMUST. He further highlighted common drawbacks in financial reporting and provided practical guidance on aligning reports with IPSAS requirements.

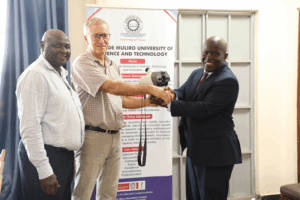

The Deputy Finance Officer, CPA Elkana Kinyor speaks at the workshop.

Complementing the focus of the University, the Deputy Finance Officer, CPA Elkana Kinyor took participants through a detailed presentation on Issues of Compliance in relations to Bank Reconciliations, Accounting of surrender of Imprests, Documentation, Accounts Payables and internal‑control self‑checks. He emphasized the need for proactive and continuous adherence to financial procedures. “Compliance is not a one-time event; it is a culture we must inculcate into our daily routines. Every transaction, every document, every approval must reflect readiness for audit,” noted CPA Kinyor.

CPA Stella Kabuga and Ms. Neddy Mung’atsia at the wokshop.

Presenting on ‘Format and Submission of Annual Financial Statement’, CPA Stella Kabuga provided a detailed overview of the standard format, structure, and submission protocols for annual financial statements in line with IPSAS and the institutional reporting guidelines. She guided the participants on the preparation of key sections such as the Statement of Financial Position, Statement of Financial Performance, Cash Flow Statement, and accompanying notes.

A section of the participants keenly follows the presentations.

The workshop also featured presenters tackling various topics including ‘Revenue Section Guidelines by CPA Betty Matiangi, Expenditures by Michael Lung’ayia, Intangible Assets Management Guidelines by CPA Fred Onaya, Bank Reconciliations by CPA Nickson Apwoka. The other notable participants included Mr. Benard Wesonga, Mr. Dennis Mumo, CPA Jemimah Minyeso, Ms. Julia Shivachi, Ms. Maria Mtimba, Mr. Joseph Kituyi, CPA Patrick Kivale, Ms. Agnes Wendo, Mr. Reagan Awich, Mr. Noah Oriedo, Ms. Faith Wamalwa, Ms. Joan Obilo, Mr. Joseph Arunga, Winnie Chebii, Mr. Patrick Wanambisi, Mr. David Cheserek, Ms. Neddy Mung’atsia and Mr. Joseph Maenga.

The Student Finance staff during their presentation.

The workshop presented an opportunity for the staff to engage in technical presentations highlighting challenges faced and possible remedy measures, peer discussions, case study analysis, and plenary sessions. “The workshop has been incredibly enlightening and has addressed many ‘Grey areas’ we encounter in our daily work. It has clarified compliance issues we often face in our roles, especially around documentation and reporting. I now feel more confident in preparing audit-ready records and contributing to the goal of zero audit queries,” said Mr. Kituyi.

Mr. Joseph Kituyi makes his remarks at the workshop.

Indeed, the relevance of this workshop cannot be overstated. Breakdown in communication across departments often leads to audit queries and compliance failures. By encouraging such workshops that uphold ‘horizontal communication’, creating a platform where staff share experiences, clarify common challenges, and co-develop practical solutions, institutions not only strengthen teamwork but also build a unified approach that reduces risks and enhances the overall institutional performance. The Finance Department’s commitment to achieving zero audit queries marks a bold and strategic shift for MMUST, anchoring its operations on transparency, accuracy, and shared responsibility.

By Linet Owuor